by Conrad H. Blickenstorfer, RuggedPCReview.com, photography by Carol Cotton

The 5th Annual DisplaySearch Conference took place in conjunction with InfoComm 2012 at the Las Vegas Hotel next to the Las vegas Convention Center. It was a one day affair of presentations and informations in the well-air-conditioned LVH (which used to be the Las Vegas Hilton). We counted about 100 attendees.

The 5th Annual DisplaySearch Conference took place in conjunction with InfoComm 2012 at the Las Vegas Hotel next to the Las vegas Convention Center. It was a one day affair of presentations and informations in the well-air-conditioned LVH (which used to be the Las Vegas Hilton). We counted about 100 attendees.

The conference consisted of four sessions with three or four speakers each. The sessions covered the digital signage hardware supply chain, supporting technologies, go-to-market strategies, and advanced and emerging technologies. The presentations were first rate, as were the moderation and supporting materials.

Here's how it all went:

Paul Semenza, Senior Vice President, Analyst Services, at DisplaySearch, welcomed everyone to this 5th annual digital signage conference, outlining how DisplaySearch has been following and covering digital signage in considerable detail for years.

Paul Semenza, Senior Vice President, Analyst Services, at DisplaySearch, welcomed everyone to this 5th annual digital signage conference, outlining how DisplaySearch has been following and covering digital signage in considerable detail for years.

Jason McGraw, Senior VP for Expositions at InfoComm, mentioned the digital signage pavilion, that InfoComm12 had almost 1,000 exhibitors in total, and this was the largest global show for the digital imaging industry. Goal is to cover the business of digital signage from every angle.

Jason McGraw, Senior VP for Expositions at InfoComm, mentioned the digital signage pavilion, that InfoComm12 had almost 1,000 exhibitors in total, and this was the largest global show for the digital imaging industry. Goal is to cover the business of digital signage from every angle.

State of the market

Chris Connery, VP for PC and Large Format Displays at DisplaySearch, introduced himself as MC for the day, and presented a "30,000 foot overview of digital signage" and a state of the market, tracking and forecast. Chris mentioned that DisplaySearch covers everything in the display industry, from components to manufacturing, OEM and ODM as well as finished goods and the channel.

Chris Connery, VP for PC and Large Format Displays at DisplaySearch, introduced himself as MC for the day, and presented a "30,000 foot overview of digital signage" and a state of the market, tracking and forecast. Chris mentioned that DisplaySearch covers everything in the display industry, from components to manufacturing, OEM and ODM as well as finished goods and the channel.

While digital signage covers is used in all sorts of smaller scale point of decision applications (pricing labels, shelf talkers, etc.) with small LCDs, electronic paper and POS advertising, it is large format displays (32 inch and above) that people think of when they envision digital signage.  Chris explained the different flat panel display technologies, by light emission (emissive and non-emissive), by driving, by materials, by process, and by type of liquid crystal. He mentioned that the industry is very much focussed on LCD based large format displays (LFDs), and that in terms of area volume, large area applications dominate. And in those, TVs dominate. Public displays are still only a small, albeit growing, segment of that.

Chris explained the different flat panel display technologies, by light emission (emissive and non-emissive), by driving, by materials, by process, and by type of liquid crystal. He mentioned that the industry is very much focussed on LCD based large format displays (LFDs), and that in terms of area volume, large area applications dominate. And in those, TVs dominate. Public displays are still only a small, albeit growing, segment of that.

In terms of history, we've seen a progression of "generations." In signage and displays, a "gen" refers to glass size that then can be cut into a number of displays. In the year 2000 it was Gen 4 with up to 17 inches, and now we are at Gen 10' with 6 up 65 inch displays. Sharp currently has the biggest motherglass in Gen 10, and plasma displays are now reaching 150 inches. Current questions include whether the next step will be, say, a concentration on outdoor displays.

Chris mentioned how a lot of people talk of "LED TVs" when that simply means a LED backlight for an LCD display. LED backlight usage in public displays is still behind, with just 18% in 2012.

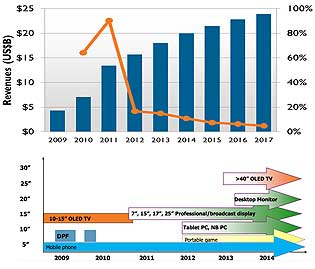

As for forecasts, 2.7 million large displays for commercial applications sold in 2011, and DisplaySearch projects 9.5 million by 2017. That's a 25% compound annual growth rate 2007 to 2017, much higher than notebooks or TVs. Market leaders are Samsung, NEC, Panasonic, LG, and Sharp. In plasma it is Panasonic, one of the few still doing plasma in this market. There is a large number of other manufacturers. That is because it is a very fragmented market with complex integration, very different applications, very different logistics, and very different needs. Different manufacturers specialize on different parts and areas of the market.

Often, standard TVs are used in digital signage applications, and their numbers are actually much larger than those of dedicated panels.

Among the questions are whether LCD can conquer other applications and markets, including use in video walls where multiple displays make up the picture, instead of LED modules.

Bezel width is an issue in commercial applications and, especially, for use in video walls so there won't be distracting grid lines. Most commercial LFDs have very narrow bezels, but narrow and ultra narrow bezel displays cost a lot more. In terms of cost, LCD technology is still costlier than LED, but offers much higher resolution and is competitive when high resolution is needed.

With electronic paper applications, displays must pop! That means at least 4500 nits outdoor. TV brightness is now at 450 nits or less, but the brighter the better. Higher res is coming, with 4K TV coming having great potential, especially for 3D. Buzz words like "retina display" will help.

Interactive whiteboards are quite popular, with Sharp offering many.

Overall, digital signage has high growth rates, higher than even notebooks. LCD is the most pervasive technology. Digital signage is using many different technologies.

Session I: Digital Signage Supply Chain

Hidetoshi Himuro, Director IT and FPD, DisplaySearch Japan, began his presentation on the digital signage supply chain with a look at the Tokyo Sky Tree Observatory with its giant displays for tourists.

Hidetoshi Himuro, Director IT and FPD, DisplaySearch Japan, began his presentation on the digital signage supply chain with a look at the Tokyo Sky Tree Observatory with its giant displays for tourists.  He showed a matrix of the public display segmentation and presented a summary of requirements beyond standard TVs in terms of size, brightness bezels, and value added differentiation.

He showed a matrix of the public display segmentation and presented a summary of requirements beyond standard TVs in terms of size, brightness bezels, and value added differentiation.

In terms of size, we'll see larger and larger displays (with majority being in 50 to 65 inches by 2015), and the trend will be towards full 1920 x 1080 HD. Shipment forecasts show rapidly incasing share in emerging markets (like China and Latin America). 3D penetration will grow from less than one percent now to 2-5 percent the next couple of years. Brightness will go beyond 1,000 nits for heavy use aps. Unique new display technologies such as transparent LCDs, glassless LCD, etc., will be used to generate interest and attention grabbing. Also multi-touch in public apps.

From a business perspective, it's important to understand the purpose and requirements for each application. For advertising, it is value added. In communication, it should be interactive. In operations, it must be network connected. In contact, there should be information gathering.

Interesting: showing the same image or ad in numerous displays so that people who are walking and do not want to stop will still get it (see image to the right). Displays can be used as bright attention grabbers, curved displays and other unique display technologies can add to the wow factor. In situations where people just wait for the next thing, like exiting at the next train station, displays can be used to fill that time with information or ads (whether we like it or not).

Interesting: showing the same image or ad in numerous displays so that people who are walking and do not want to stop will still get it (see image to the right). Displays can be used as bright attention grabbers, curved displays and other unique display technologies can add to the wow factor. In situations where people just wait for the next thing, like exiting at the next train station, displays can be used to fill that time with information or ads (whether we like it or not).

In stores, video walls can be used to create a climate for good shopping, create an image or mood, and change quickly.

Vending machine displays with touch can analyze needs and recommend different kinds of drinks or solutions. Information displays that can be panned and zoomed help in orientation and finding things.

All of this contributes to creating a successful business model with digital signage technology.

This is a solutions business! To be successful, purpose and functionality must be carefully studied, pitfalls avoided, and technology must be exploited for the best possible wow factor.

Mike Marusic, Senior VP at Sharp, Business Solutions (and a great presenter), stated that the future is big and interactive. This means translating technologies people know and love from home and work into public displays. So, having large screens at home means even larger, brighter one in public and the office (he said Sharp sold a million 70 inch screens last Christmas in U.S. alone). Touch and multi-touch will move up into professional audio video.

Mike Marusic, Senior VP at Sharp, Business Solutions (and a great presenter), stated that the future is big and interactive. This means translating technologies people know and love from home and work into public displays. So, having large screens at home means even larger, brighter one in public and the office (he said Sharp sold a million 70 inch screens last Christmas in U.S. alone). Touch and multi-touch will move up into professional audio video.  Large interactive displays will be used in numerous new areas, from info displays where there used to be none, to replacing panel displays in things like copiers and numerous other machines.

Large interactive displays will be used in numerous new areas, from info displays where there used to be none, to replacing panel displays in things like copiers and numerous other machines.

All of this requires a massive supply chain. Sharp has a one mile by one mile facility that makes 10th gen panels! Investment is huge. Larger mother glass means being more cost effective and more flexible. Sees significant growth in large and larger displays. For multi screen walls, it is actually cheaper and less complex to use fewer large displays than a larger number of smaller displays. And the is less of a bezel issue. Almost everyone now offers or has announced displays over 80 inches.

Opportunity in great variety of customized applications, and large displays are the visible part of it. Also mentioned the Microsoft Kinect controller and Microsoft app that recognizes your face. In the office, large screens and video walls are ever more common, and there is no need for draperies and all as is the case with older projectors. No need to turn out lights. Interactive white boards also used much in office. Displays used to create environments and moods. This can be done in paper and print, but those cannot be changed easily and are static. In theater, backgrounds can be changed instantly, and the scenery becomes part of the show.

One challenge is that the new display technologies will cannibalize older projection technologies. And the channel must be willing to let that happen and create the new markets. Study all those interactive options. The expertise of the integrator and software developer may be 2/3 of the product, the hardware is just a small enabling part.

Daniel Smith, Director of digital signage sales, LG Electronics, spoke about consumer, hybrid and commercial displays.

Why does one display cost so much more or less than another display? When surveyed, 42 percent of respondents said they'd initially install relatively low numbers of panels. So the industry is still very price sensitive.

Daniel Smith, Director of digital signage sales, LG Electronics, spoke about consumer, hybrid and commercial displays.

Why does one display cost so much more or less than another display? When surveyed, 42 percent of respondents said they'd initially install relatively low numbers of panels. So the industry is still very price sensitive.

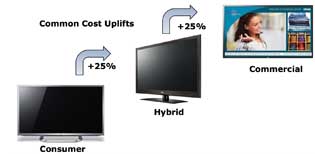

Consumer screens are designed to look good in living rooms and are lowest cost. And their pricing is falling much faster than that of commercial displays.

Hybrid screens can be remotely controlled with RS232, etc., they have different controls that can be locked, and you can quickly calibrate color and other settings. Some hybrids may have basic signage software and players built in. Hybrids have longer onsite warranties and cost about 25 percent more.

Hybrid screens can be remotely controlled with RS232, etc., they have different controls that can be locked, and you can quickly calibrate color and other settings. Some hybrids may have basic signage software and players built in. Hybrids have longer onsite warranties and cost about 25 percent more.

Commercial panels are designed to eliminate image retention, they are designed for both portrait and landscape operation, they have DVI and DisplayPort plugs, they have expanded inputs and resolutions, and the panels can be configured and controlled over IP. Displays can be daisy chained, configured as video walls, bezels can be near zero, there is better thermal design and management for 24/7 operation, they are brighter (700+ nits, up to 2,000), and there can be anti-reflection coatings. Some commercial displays can accommodate single board computers. Some are fully rugged, with metal chassis, cooling, etc.

David Loeber, Business Director, Large Cover Glass, at Corning spoke about glass products for the A/V and digital signage industries, and on trends and challenges from Corning's perspective.

David Loeber, Business Director, Large Cover Glass, at Corning spoke about glass products for the A/V and digital signage industries, and on trends and challenges from Corning's perspective.

Corning has been involved in displays for decades. With very rapidly growing resolution and streaming content, optical fiber is the solution of choice. So they are working much on optical fiber penetration and he outlined how they eliminated consumer acceptance barriers with optical cable and connectors that are invulnerable, easy to use, light, etc.

In displays, it is not just about how large the glass can be, but increasingly the substrate glass must have more advanced capabilities, and it must be thinner, lighter, and enable touch.  So how can they make the glass thinner? Corning's Willow glass is just 0.1 mm, no thicker than a sheet of paper. Loeber showed slide of rollable, flexible glass.

So how can they make the glass thinner? Corning's Willow glass is just 0.1 mm, no thicker than a sheet of paper. Loeber showed slide of rollable, flexible glass.

Touch displays have different requirements to resist damage, need to be compatible with touch technologies, comply with environmental standards, resist scratching, offer great light transmission, etc. Example is their Gorilla Glass 2.

Scratch resistance is tantamount. Also making overall glass stacks thinner, with all the filters and polarizers, eliminating gaps, different ways of stacking.

The weight difference between a Gorilla Glass large display and conventional glass display can be huge. Thin glass that is directly bonded to the panel, parallax issue are avoided.

Loeber said Corning is now getting into the dimensional glass shapes.

Q&A session moderated by Chris Connery....

4k resolution will be immediately accepted/adopted. 8k is still very costly, but use in large size conference table displays, etc., it could be adopted fairly quickly. On consumer side, existing standards may prevent quick adoption (still charging extra for HD!!!!), but on commercial side content is computer generated and could be adopted more quickly.

I talked with David Loeber of Corning after the session about the smudges and grease issue in public touch displays. They are working on it, but it is difficult. The are solutions to kill germs and such, though.

Session II: More than the Display

Kris Konrath, Director of Marketing at Convergent Media Systems (a Sony company), which is a core coordinator and provider of digital signage solutions worldwide, primarily focussed on retail and banking.

Konrath presented on advancements in content creation, management and distribution. He explained that until recently, most content was created in a more or less static way that was difficult to edit, difficult to change and customize and did not have intelligence.

Kris Konrath, Director of Marketing at Convergent Media Systems (a Sony company), which is a core coordinator and provider of digital signage solutions worldwide, primarily focussed on retail and banking.

Konrath presented on advancements in content creation, management and distribution. He explained that until recently, most content was created in a more or less static way that was difficult to edit, difficult to change and customize and did not have intelligence.

Trends now are content automation and advanced data integration that goes way past just RSS and simple data streams.

For content automation, there can now be multiple video streams where individual streams can be individually updated and edited. For example, pricing or specs in text boxes can get data directly from a database. This way, digital signage can easily be customized for regions as well.

For content automation, there can now be multiple video streams where individual streams can be individually updated and edited. For example, pricing or specs in text boxes can get data directly from a database. This way, digital signage can easily be customized for regions as well.

Konrath gave a number of examples: In restaurants, pricing and availability can quickly be edited with individual streams without having to change the entire signage file. In banking, an app may offer interest rates that can very easily be changed without redoing the entire script. In cinema, start times, etc., can easily be changed and automated. And, of course, it can be used to advertise snacks with super-easy localization.

Overall, the message is to move from static digital signage content that simply plays back to dynamic content that draws from a variety of easily updatable streams and databases.

David Levin, President and CEO of Four Winds Interactive spoke of software content management in a multi-screen world.

Four Winds has been around for seven years and their software is driving over 100,000 screens.

David Levin, President and CEO of Four Winds Interactive spoke of software content management in a multi-screen world.

Four Winds has been around for seven years and their software is driving over 100,000 screens.  Levin "digital signage" is too narrow a term; it is really about filling an increasingly high demand by consumers for information, any information. But won't personal displays cannibalize large displays? Not likely; there is a growing demand for display real estate.

Levin "digital signage" is too narrow a term; it is really about filling an increasingly high demand by consumers for information, any information. But won't personal displays cannibalize large displays? Not likely; there is a growing demand for display real estate.

Initially, digital signage was all very static and single task. Then it became multi applications, and now it's multiple interactive applications on numerous different displays, from huge to personal. He sees an accelerating move to mobile integration where offers, etc., can be downloaded onto smartphones or tablets. Cross platform integration is key.

Michael Ferrer, Vice President, Marketing at NEC.

Michael Ferrer, Vice President, Marketing at NEC.

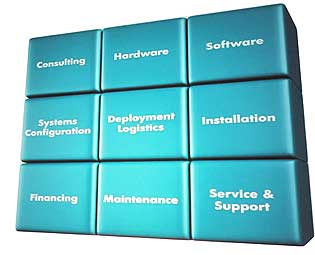

Ferrer talked about solutions offerings and services. He pointed out that NEC doesn't sell TVs; they only sell commercial grade screens. His presentation focused on how digital signage requires a whole slew of managed services ranging from hardware to software, financing, maintenance, installation, deployment logistics, etc.  Each area requires specific expertise, and companies like NEC can provide that. The lesson here is that there are numerous aspects with digital signage solutions, and a project can be sunk in any number of details.

Each area requires specific expertise, and companies like NEC can provide that. The lesson here is that there are numerous aspects with digital signage solutions, and a project can be sunk in any number of details.

Ferrer mentioned that they sold 28,000 screens to Burger King, and that items shown on the drive through displays makes up almost 80% of the business, so quick customization can really optimize business and sales. And what are the logistics in installing those 28,000 screens in off hours, and they absolutely must work in the morning?

Most of the problems they see in signage computers is overheating systems, breaking power supplies, dust and dirt inside. It's all about planning for success and not how to fix future failure!

Q&A.....

Chris Connery asked the panel about their largest applications.

Four winds; Retail, banking, csr

NEC: quick service restaurants, retail, wayfinding, digital cinema

Convergent: manufacturing, health care, gaming/hospitality

Session III: Go-To-Market Strategies

Keven Yue, Senior Manager, Business Development, at Ingram Micro presented a major distributor's perspective.

Keven Yue, Senior Manager, Business Development, at Ingram Micro presented a major distributor's perspective.

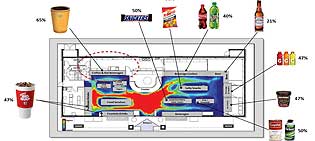

He outlined how Ingram Micro, with 2011 revenues of US$36 billion, has accumulated a vast amount of detail knowledge via 40,000 unique solution providers and over two million unique end users.  This great understanding of their customers helps them understand businesses, like the gross margins of different products in convenience stores, and how to use digital signage to drive sales of those products (like fountain sodas and hot beverages).

This great understanding of their customers helps them understand businesses, like the gross margins of different products in convenience stores, and how to use digital signage to drive sales of those products (like fountain sodas and hot beverages).

There are almost a million restaurants in the US (3/4 of them fast food) and Canada, and only a small percentage of those have digital signage.

The emphasis of Yue's presentation was that there is a need to truly understand markets down to the last detail to arrive at a successful signage deployment.

Josh Byrd, Director of Marketing at NanoLumens in Georgia, spoke about bringing imagination to market.

Josh Byrd, Director of Marketing at NanoLumens in Georgia, spoke about bringing imagination to market.

He mentioned that their company started in 2006 on the idea of using flexible instead of rigid LED displays.  Their products are thin, light, and usually quite large. And some even come in triangles and other shapes. They have large displays that wrap around columns and drums. The flexible nature of their LEDs allows for unusual, eye-catching solutions.

Their products are thin, light, and usually quite large. And some even come in triangles and other shapes. They have large displays that wrap around columns and drums. The flexible nature of their LEDs allows for unusual, eye-catching solutions.

Byrd's presentation centered in how new and small companies that have no big track record, and whose new technology cannot be compared to anything else on the market, can succeed. How? Byrd's answer is with innovative products, identifying specific verticals, being fearless, deal with good distribution partners, and good marketing.

By the end of his speech I really wanted to know more about their actual technology, and I got to see that the next day at their show floor display at InfoComm12. Impressive indeed. Their smallest display is 112 inches diagonally, and their largest 224 inches!

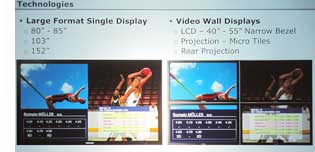

Karl DeManss, Group Manager, Panasonic Solutions Company discussed the right display solution for any given application and presented a comparison between multi-display and large-format display solutions.

Karl DeManss, Group Manager, Panasonic Solutions Company discussed the right display solution for any given application and presented a comparison between multi-display and large-format display solutions.

Large format single displays, which go up to 152 inches now, have no bezels whereas video walls do have the distracting bezels.  Most large format screens sold to financial industry. But both technologies have their uses and applications. No matter what technology, though, ultimately it's all about content.

Most large format screens sold to financial industry. But both technologies have their uses and applications. No matter what technology, though, ultimately it's all about content.

Image quality considerations: large format displays usually are limited to 1920 x 1080. Video walls can do several times that resolution, but it's a scaled up process. Lighting conditions are important. In public places bright LCD is probably better, but in controlled environments plasma has better image quality. Single displays have total uniformity whereas video walls may have panels that are lighter or darker or have different colors. Replacement displays will look different.

150 inch displays are difficult to move and deliver. They may not fit through doors or elevators. No such problem with video wall components, but getting all the individual screens mounted properly is more difficult. Connectivity can be an issue, with walls needing more cables. Power can be an issue. Start up surge of a large single panel can overwhelm a circuit. Large format plasmas have 100,000 hour life, but LCDs only about 50,000. Large displays cost more, but overall cost may not be much more.

A very good presenter, DeManss emphasized that Panasonic makes all three technologies, but he did seem to make the case for the large format displays.

Session IV: advanced and emerging display technologies for digital signage

Dr. Jennifer Colegrove, VP, Emerging Display Technologies, DisplaySearch talked about touch and emerging displays for digital signage.

Dr. Jennifer Colegrove, VP, Emerging Display Technologies, DisplaySearch talked about touch and emerging displays for digital signage.

Emerging display technologies include OLED, flexible, 3D, pocket projectors, etc.

Overall flat panel display market currently about 110 billion. Touch screen module market about 14 billion in 2011.

In terms of touch screen technologies there are digital and analog resistive, surface capacitive, projected capacitive, infrared, surface and bending acoustic wave, optical imaging, various in- and on-cell sensing methods, electro magnetic digitizers, force-sensing, and various combo/hybrid solutions. The are almost 200 touch screen suppliers, with by far the most resistive and projected capacitive. Of all touch applications, only about 1% are in digital signage.

In terms of touch screen technologies there are digital and analog resistive, surface capacitive, projected capacitive, infrared, surface and bending acoustic wave, optical imaging, various in- and on-cell sensing methods, electro magnetic digitizers, force-sensing, and various combo/hybrid solutions. The are almost 200 touch screen suppliers, with by far the most resistive and projected capacitive. Of all touch applications, only about 1% are in digital signage.

Of that one percent, most is retail and POS, then point of information, education and training, and ATMs. But still only about 16 million units by 2017.

Public touch terminals need to be very durable, so resistive is usually ruled out because it wears and can be scratched.

Emerging display technologies include OLED. There are now 55-inch OLED displays by LG and Samsung. 40+ OLED TVs should be available end of this year. Mitsu already in 2010 offered a 100 inch passive OLED, but that is different. PMOLED will not have big growth due to low brightness, cost, short lifetime. OLED not suitable yet.

Flexible displays have existed for a while, but only passive matrix. We'll see active matrix flexible displays this year or next (mentions the "wow" factor). Expected growth to about US$6 billion by 2015.

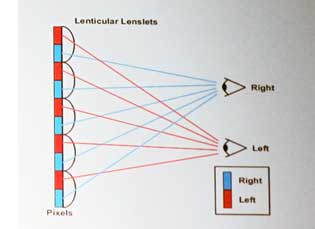

3D: over 20 million 3D TVs were sold in 2011. Colegrove believes 3D is very suitable for public displays, again because of the wow factor. 10,000 units shipped in 2009, expect 1.2 million in 2018. Virtually all public 3D are no-glasses types. 75k units in 2011, about 3% of all public displays!

Maarten Tobias, CEO at Dimenco that began as a spin-off of Philips, claimed that 3D digital signage, without the need of glasses, is not some future technology; it is happening now. His presentation began with a hilarious video of a researcher who claimed to have the ultimate solution for glasses-free 3D, and then demonstrates devices you stick on your temples and make your eye lids flutter...

Maarten Tobias, CEO at Dimenco that began as a spin-off of Philips, claimed that 3D digital signage, without the need of glasses, is not some future technology; it is happening now. His presentation began with a hilarious video of a researcher who claimed to have the ultimate solution for glasses-free 3D, and then demonstrates devices you stick on your temples and make your eye lids flutter...

In real life, Tobias said, 3D has been much less successful than the number of units sold would indicate. It is not expensive to add 3D to a TV, so many models now include it, but people often don't even buy the glasses.  Quoting James Cameron, Tobias said that 3D won't become compelling until autostereoscopic displays arrive, displays that do not require glasses.

Quoting James Cameron, Tobias said that 3D won't become compelling until autostereoscopic displays arrive, displays that do not require glasses.

Tobias explained his company's lenticular 3D that uses textured overlay that make each eye see different image. Still a bit fuzzy, but should be much improved with 4k displays. The technology sounded a bit like a motion version of 3D greeting cards and stickers.

His argument is that a 3D display has more of a wow factor and people watch it longer. He cited a test where people paid 44% more attention to a 3D display and added almost 10% extra sales (but will that hold up once novelty wears off?).

I came away with the impression that the digital signage industry sees 3D as something to stop people and make them look, resulting to higher sales. This is very different from consumer 3D.

Scott Hagermoser, who is Global Business Development Manager at 3M Touch, talked about how to explain touch technologies to decision makers, and why "big-touch" feels different than an iPhone or iPad.

Scott Hagermoser, who is Global Business Development Manager at 3M Touch, talked about how to explain touch technologies to decision makers, and why "big-touch" feels different than an iPhone or iPad.

700 million smartphones and tablets sold in 2011, almost all with projected capacitive touch screens. As a result, people expect anything that looks like an iPad to have a touch first interface. And they expect multi finger interaction, even on large format signs.

The current state of big touch technologies is that infrared solutions are scalable to over 100 inches, but they need a bezel, hate bright light, and have pre-touch issues. Infrared optical camera solutions have similar issues. The big problem is that if a display looks like a phone, even if it is much larger, people expect it to act like a smartphone. With the same elegance and responsiveness. So the glass must be smooth, non-stiction.

The current state of big touch technologies is that infrared solutions are scalable to over 100 inches, but they need a bezel, hate bright light, and have pre-touch issues. Infrared optical camera solutions have similar issues. The big problem is that if a display looks like a phone, even if it is much larger, people expect it to act like a smartphone. With the same elegance and responsiveness. So the glass must be smooth, non-stiction.

What technologies can deliver the small touch feel on a big display? One is infrared optical with four or six cameras, but it doesn't fit all applications. In cell, pixel sense technology has good potential and even allows finger hovering. Detects IR light reflected from finger. Projected capacitive (procap) can be scaled to 82 inches and fills just about any requirement. But it comes at a cost for now.

Other considerations are landscape or portrait orientation, how many touch points are needed, whether there are multiple users, issues of palm and arm rejection, etc. With touch technologies evolving so quickly, Hagermoser also suggested "future proofing" projects so that expensive deployments won't be obsolete quickly.

Q&A....

The panel talked about the still considerable cost of procap.

We greatly enjoyed the conference, and are looking forward to the next one. Thanks to Stacy Harmon and Laura Castellano at DisplaySearch for making RuggedPCReview.com's presence possible! -- Conrad H. Blickenstorfer, Editor-in-Chief